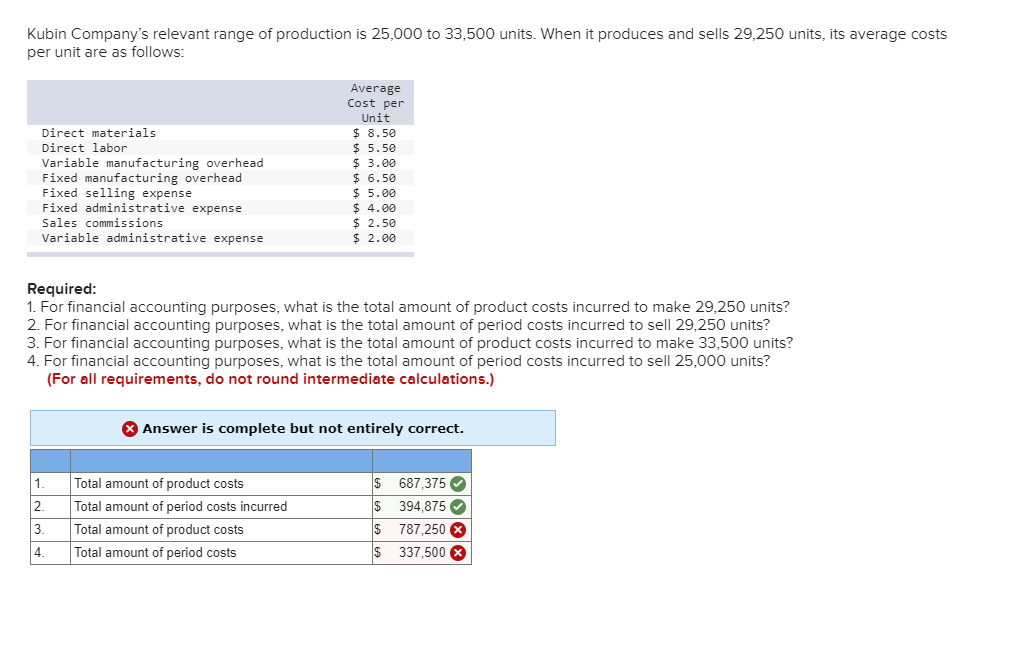

Typically, variable overhead costs tend to be small in relation to the amount of fixed overhead costs. Variable overhead costs can change over time, while fixed costs typically do not. Utilities such as electricity and gas used in the production process also fall under variable overheads.

Variable Overhead Efficiency Variance Formulas and Examples

- Let’s say the company increases its sales of phones, and in the following month, the company must produce 15,000 phones.

- Variable manufacturing overhead costs differ based on how much the company produces.

- Who knows how this community would be different had Alfred Grosjean, or Auguste Cordier lived long enough to guide the company into the future.

- You can also see, on the front of the building, the word “Agate” – which was what Grosjean called his product (more on that later).

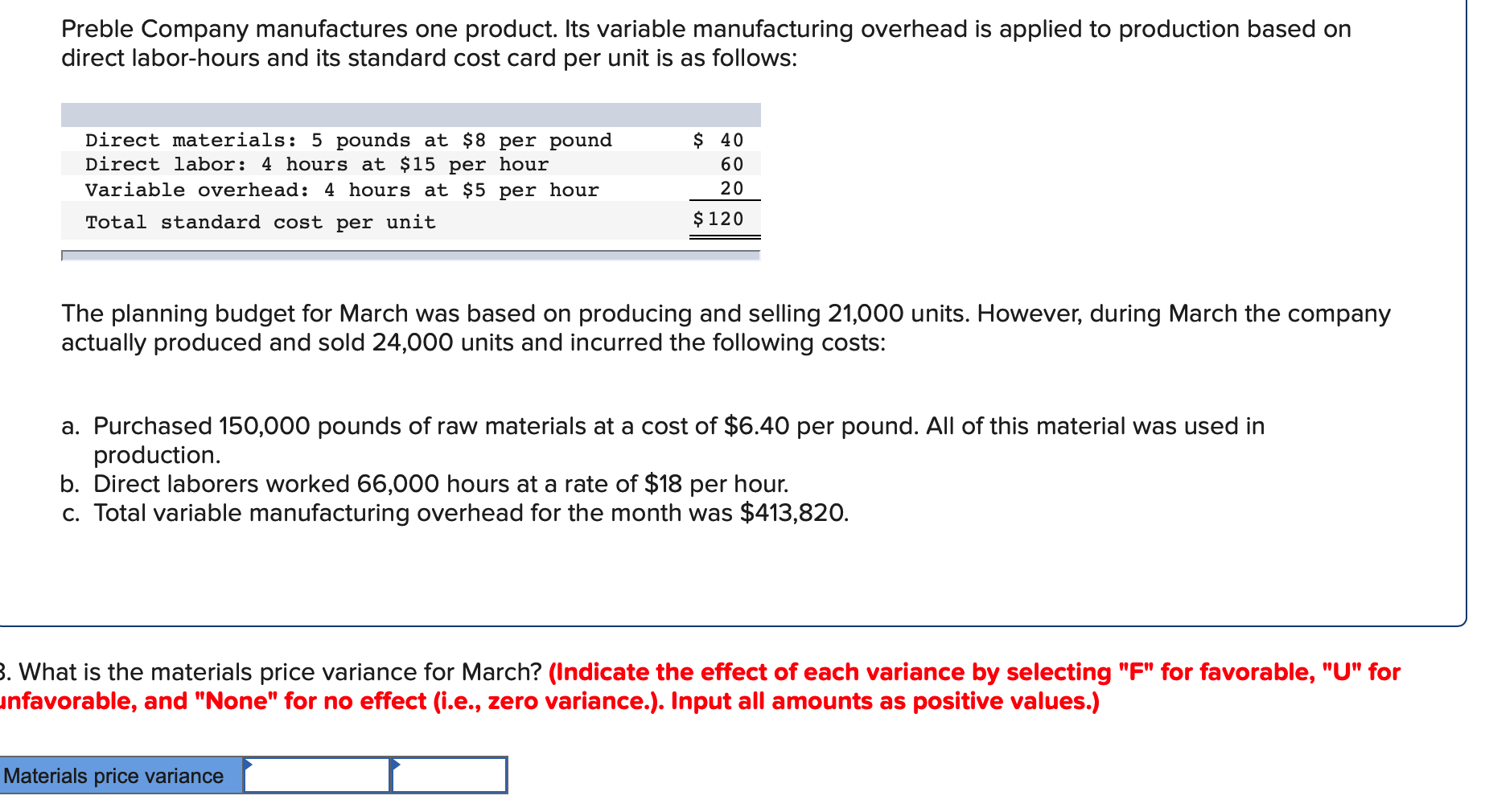

These costs are then allocated to each unit that’s produced and documented as part of the cost of goods sold in a manufacturer’s master budget. While the direct costs of labor and materials are usually easy to calculate based on production volumes, variable overhead costs are not so easy. Variable manufacturing costs vary roughly with changes in production volumes.

Manufacturing Overhead Per Unit Formula

The first thing you have to do is identify the manufacturing overhead costs. Now that you have an estimate for your manufacturing overhead costs, the next step is to determine the manufacturing overhead rate using the equation above. Such variable overhead costs include shipping fees, bills for using the machinery, advertising campaigns, and other expenses directly affected by the scale of manufacturing. Variable overhead costs are costs that change as the volume of production changes or the number of services provided changes.

Track Costs With One-Click Reports

It’s added to the cost of the final product, along with direct material and direct labor costs. Manufacturers must include variable overhead expenses to calculate the total cost of production at current levels, as well as the total overhead required dependent care expenses to increase manufacturing output in the future. The calculations are applied to determine the minimum price levels for products to ensure profitability. Manufacturing overhead costs are the indirect expenses required to keep a company operational.

Deliver your projectson time and on budget

Calculating these beforehand can help you plan better and reduce unexpected expenses. A variable overhead spending variance is the difference the actual costs and what it should have cost based on the activity level. After the production period has ended, the business reviews costs and determines actual variable manufacturing overhead. Accountants do this by calculating how much was actually spent in variable manufacturing overhead during the period. When performing this calculation, accountants must be careful to calculate the amount of overhead used in production rather than the value of items purchased. For example, if the company purchased $500 worth of machine supplies but only used $400 of the supplies during the period, the accountant only includes $400 in the variable expense calculation.

Understanding Variable Overhead Costs

If the variance is significant, management will investigate what caused the variance. Variances in variable manufacturing overhead are classified as either a spending variance or an efficiency variance. Unfavorable spending variances occur when the factory purchases items at a higher rate than expected. For example, if the cost of a kilowatt of electricity went up or if a purchaser had to pay more on machine supplies than usual, there could be a spending variance. Unfavorable efficiency variances occur when the factory uses more variable overhead per unit than expected.

It encompasses all the indirect expenses tied to the manufacture of products that are not fixed costs. Let’s say the company increases its sales of phones, and in the following month, the company must produce 15,000 phones. At $2 per unit, the total variable overhead costs increased to $30,000 for the month.

Since it varies with production volume, an argument exists that variable overhead should be treated as a direct cost and included in the bill of materials for products. You can also use the formula below to calculate a predetermined manufacturing overhead cost rate that will be allocated to all the units that are produced instead of allocating overhead costs to each of them. Continuous improvement methodologies, such as Lean and Six Sigma, can also be employed to streamline processes and reduce waste. By focusing on value-added activities and eliminating non-essential tasks, companies can lower the consumption of indirect materials and utilities, thus reducing variable overheads. Additionally, investment in energy-efficient machinery and equipment can lead to long-term savings in utility costs, which are often a significant portion of variable overheads. Indirect labor is another component, which refers to the wages of employees who are not directly involved in the production of goods but whose work is related to the production process.

If variable manufacturing costs are significantly different than expected, the business will perform variance analysis to identify the underlying cause. It is assumed that the additional 8 hours caused the company to use additional electricity and supplies. Measured at the originally estimated rate of $2 per direct labor hour, this amounts to $16 (8 hours x $2).

Note that both approaches—the variable overhead efficiencyvariance calculation and the alternative calculation—yield the sameresult. In this case, the variance is favorable because the actual costs are lower than the standard costs. There are a few business expenses that remain consistent over time, but the exact amount varies, based on production. For example, companies have to pay the electricity bill every month, but how much they have to pay depends on the scale of production. For instance, during months of heavy production, the bill goes up; during the off season, it goes down.